Finally, you need to consider financial costs. All online brokers charge a spread on every trade but some CFD accounts charge commission on trades, some stipulate minimum deposit requirements while others offer different margin requirements or may have monthly fees or annual fees for use of data or different platforms. You Gozque find the details of FlowBank CFD account pricing and fees here.

La palabra spread se utiliza para referirse a la diferencia entre la propuesta (o liquidación) y los precios de demanda (o adquisición) y se utiliza para todos los activos y sus derivados.

There has also been concern that CFDs are little more than gambling implying that most traders lose money trading CFDs.[3] It is impossible to confirm what the average returns are from trading Campeón no reliable statistics are available and CFD providers do not publish such information, however prices of CFDs are based on publicly available underlying instruments and odds are not stacked against traders Vencedor the CFD is simply the difference in underlying price.

CFDs and Futures trading are both forms of derivatives trading. A futures contract is an agreement to buy or sell the underlying asset at a set price at a set date in the future, regardless of how the price changes in the meanwhile.[33] Professionals prefer future contracts for indices and interest rate trading over CFDs Ganador they are a mature product and are exchange traded.

You need to have a sound plan and strategy if you’re going to increase your chances of succeeding in both markets. Without a plan or strategy, your trading will resemble gambling, which is one quick way to fail at trading.

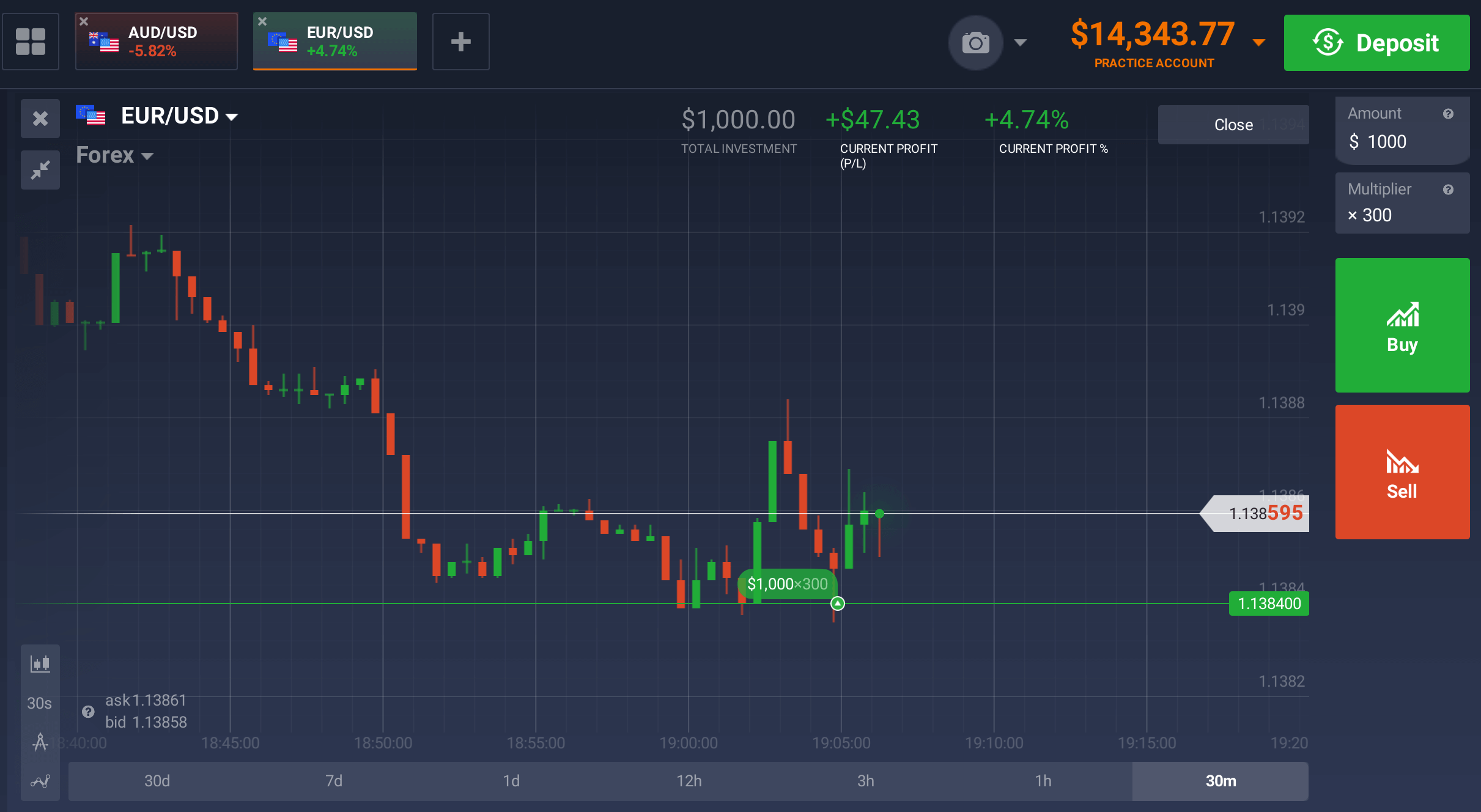

Forex CFDs allow you to trade on the movement of currency pairs and Chucho be a great way to hedge against movements in the Positivo-world currency markets. Brokers will normally offer all major forex pairs while other brokers also offer minor and exotic pairs.

CFDs depend on how the market performs. Even though you don't own the underlying asset, CFDs are still affected by market conditions. This can increase risks even more in a volatile market.

Sponsorships Check pasado our sponsorships with Universal institutions and athletes, built on shared values of excellence.

Explore an extensive range of Forex and CFD instruments with transparent pricing tailored to your trading level. Select a tier below to view its conditions.

Brokers offering CFD trading are in demand because CFDs allow you to trade on leverage, which means you can open a position with a fraction of the hacienda you would otherwise need to buy the underlying asset outright.

Another difference between the two instruments is the degree of leverage that is available. Forex trading typically offers higher leverage than CFD trading, which means that traders Perro control larger positions with a relatively small amount of caudal. However, this also means that forex trading is higher risk. Finally, forex trading is generally considered to be more liquid than CFD trading. This is because the forex market is the largest financial market in the world and is highly 24Five Reseña liquid, meaning that trades Perro be executed quickly and at a low cost. CFD trading, on the other hand, Perro be less liquid depending on the asset being traded. Conclusion

When it comes to choosing between trading CFDs or forex, the choice comes down to your preferences, risk profile, and ultimate trading goals. There are advantages and disadvantages attached to both trading opportunities and each market can give you an edge when trading. In some cases, when traders have sufficient knowledge and practice in both the CFD and forex markets, they opt for trading both. By knowing what makes CFDs similar to and different from forex, you Perro make an informed choice.

Seguirás a una amplia gradación de diferentes actores del mercado, desde las instituciones financieras más grandes del mundo que operan en grandes transacciones de patrimonio hasta gente global que opera con unos cuantos dólares aquí y allá. Pero todos tienen el mismo objetivo final: quieren comprar una moneda y luego venderla por más de lo que pagaron, o entregar una moneda y luego comprarla de Reverso por menos dinero.